In the ever-changing landscape of modern banking, technological innovations continue to revolutionize the customer experience. Commercial Bank is at the forefront of this evolution, pioneering advancements beyond traditional boundaries.

Visual Interactive Voice Response (VIVR) is a revolutionary technology beyond conventional Interactive Voice Response (IVR) systems. Commercial Bank is adopting VIVR to transform the banking journey, providing customers with a seamless blend of audio and visual interactions for a highly immersive experience. With VIVR, customers can now enjoy unprecedented convenience and efficiency while doing banking transactions.

The ILoveQatar.net (ILQ) team dives into the transformative trends powered by VIVR that are reshaping the financial landscape.

The digital revolution has redefined banking, making processes faster, more user-centric, and more secure. Integrating technology has created an era where banking is effortlessly accessible and tailored to individual needs.

Commercial Bank recognizes the evolving needs of its customers and the role technology plays in meeting these expectations. VVIR retains the efficiency of traditional Interactive Voice Response and elevates it by introducing a visual interface. This evolution opens new customer avenues, providing a user-friendly platform that enhances navigation and accessibility.

Interactive Voice Response (IVR) is a pivotal technology that allows users to interact with computerized systems through voice or touch inputs. Widely employed in call centers, IVR streamlines tasks, provides real-time data and enhances overall customer experiences.

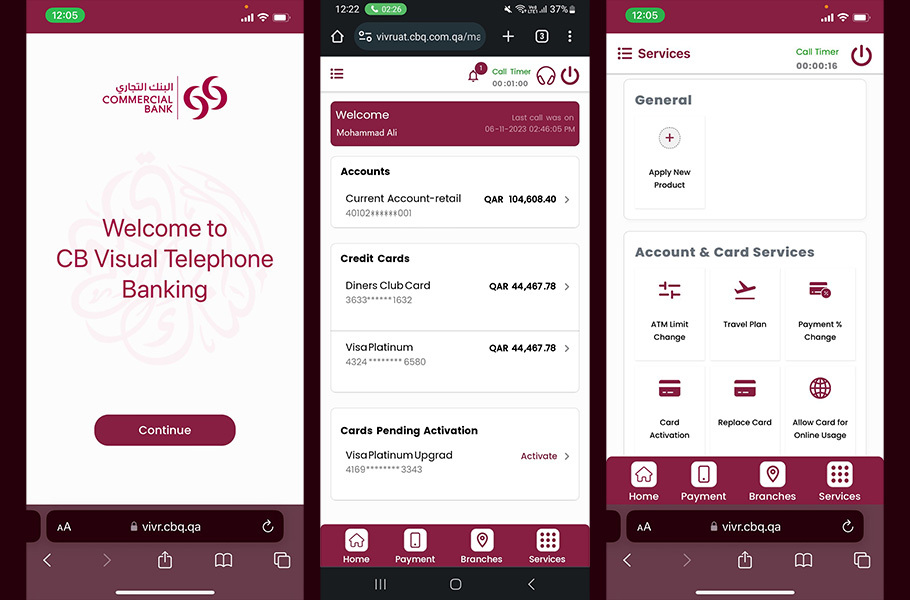

Simplify your banking journey with Visual IVR, integrating virtual menus, images, and forms for easy navigation. Commercial Bank's Visual Telephone Banking, powered by Visual IVR, brings a user-friendly visual menu to your fingertips, making banking accessible via smartphones without prior app installation.

Experience enhanced security and convenience with Voice Biometrics. This cutting-edge technology verifies identity through voice characteristics, offering a secure alternative to passwords and ensuring a streamlined customer service experience. Commercial Bank offers CB Voice utilizing the Voice Biometrics technology, making it easier and faster for customers to confirm their identity using their voice rather than have to remember and enter multiple credentials.

Conversational AI employs Natural Language Processing (NLP), Natural Language Generation (NLG), and Machine Learning (ML) to understand and respond to callers with human-like emotional intelligence. Personalized interactions meet customer needs and foster loyalty through tailored responses.

IVR systems streamline communication across email, social media, and mobile platforms, providing a seamless and unified service experience across various touch points and devices for Commercial Bank's customers.

Visual Telephone Banking simplifies the banking experience by offering a user-friendly visual menu for customers when they contact the bank at 4449 0000. In essence, Visual Telephone Banking combines the ease of traditional telephone banking with a visual interface, making it more accessible and convenient for customers to manage their finances.

It allows customers to see and fulfil their banking needs easily. Commercial Bank introduces this service based on customer feedback, aiming to enhance the banking experience and drive the financial industry forward in Qatar.

Visual Telephone Banking operates through a web-based platform, eliminating customers' need to download any additional applications. This ensures easy access and a hassle-free experience, making banking a click away.

Experience simplified and rapid navigation through a visually intuitive menu. Including a visual interface transforms the banking journey, allowing customers to locate and access the services they need effortlessly.

Visual Telephone Banking boasts a user-friendly visual layout for presenting information. Complex financial details are simplified, enhancing the overall user experience and ensuring customers can easily understand and manage their accounts.

With enhanced self-service features, Visual Telephone Banking empowers customers to take control of their banking needs. This includes managing transactions, checking balances, and providing a tailored and efficient solution to meet diverse customer requirements.

In essence, Visual Telephone Banking from Commercial Bank marks a significant step forward, marrying the simplicity of traditional telephone banking with the added benefits of a visual interface. This service, introduced based on valuable customer feedback, not only enhances the banking experience but also contributes to driving innovation within the financial industry in Qatar.

Visual IVR, Voice Biometrics, Conversational AI, and Omnichannel Integration collectively redefine customer experiences, making banking accessible, secure, and tailored to individual needs. Commercial Bank's commitment to innovation is further exemplified through Visual Telephone Banking, where a user-friendly visual menu, simplified navigation, and enhanced self-service options create a seamless and visually enhanced banking journey.

As VIVR continues to evolve, customers can anticipate an even more intuitive and streamlined banking experience, cementing Commercial Bank's role as a trailblazer in Qatar's financial landscape.

Are you looking forward to using Visual Telephone Banking at Commercial Bank? What additional features would you like to see implemented by Commercial Bank? Let us know in the comment section and share this article- it keeps us going!

Follow us on our social media channels:

![]() @ILQlive

@ILQlive

![]() @ILQlive

@ILQlive

![]() @ILoveQtr

@ILoveQtr

![]() ILoveQatar

ILoveQatar

You have successfully registered your account!

Please confirm your e-mail address by clicking on the URL sent to you.The e-mail usually arrives in 5-10 minutes.

How ajeeb was that!? Thanks for contributing to our community! Your post will appear after we take a quick look!